News Summary

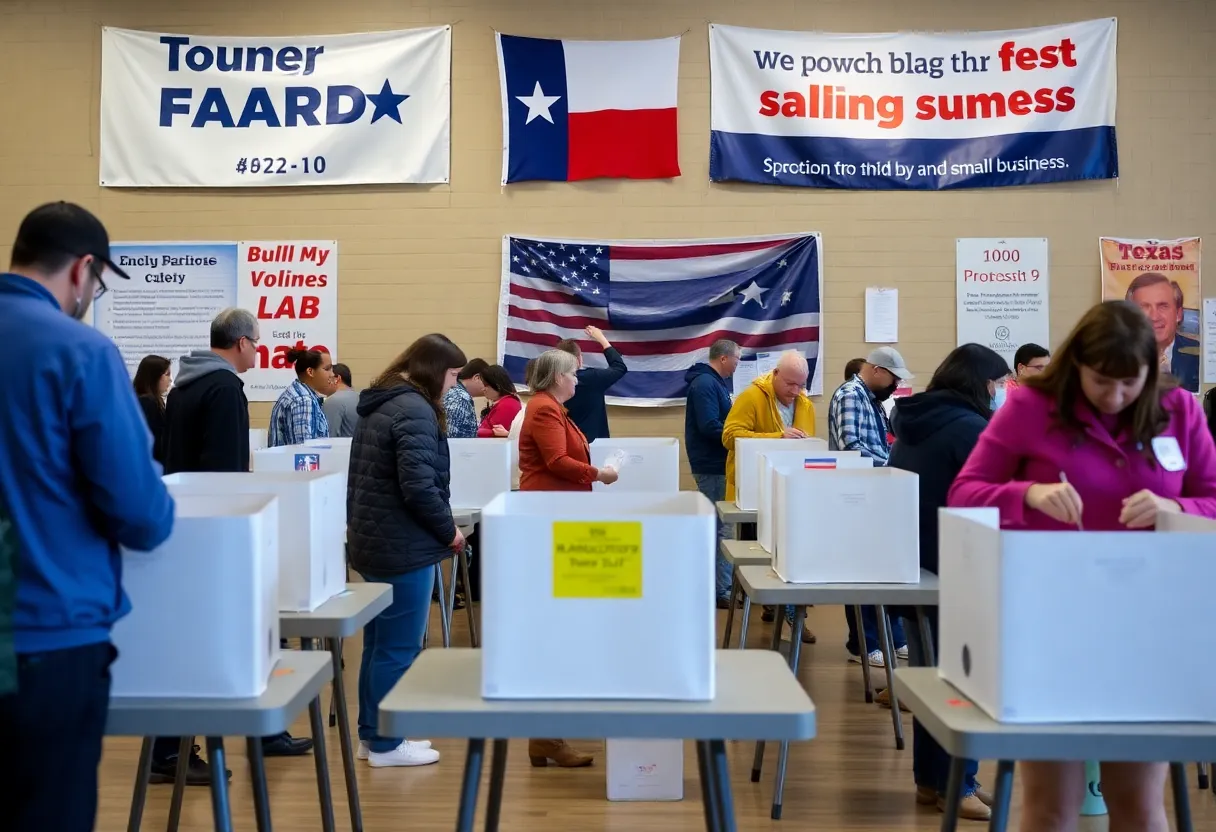

Texas has kicked off early voting as voters prepare to cast their ballots for multiple propositions, with particular attention on Proposition 9. This measure aims to significantly raise the inventory tax exemption for small businesses, offering potential financial relief and encouraging economic growth. With the election date approaching, voters are urged to stay informed about the implications of this and other proposals on the ballot, which could reshape property tax obligations for many residents and businesses across the state.

AUSTIN, Texas – Early voting for the state’s propositions is set to commence on Monday, October 20, 2025, and will continue until Friday, October 31, 2025. The general election day will take place on November 4, 2025, allowing voters the opportunity to decide on various propositions, including Proposition 9, which supporters argue will provide essential relief to small businesses in Texas.

Proposition 9 seeks to significantly raise the inventory tax exemption for businesses—specifically, increasing the exemption from $2,500 to a substantial $125,000. This change is aimed directly at reducing the financial burdens placed on small business owners who currently face taxes on all items owned. The current form of this tax is often regarded as the “inventory tax,” and its elimination or reduction has been highlighted as a critical factor for fostering economic growth within the small business sector.

Proponents of Proposition 9 assert that alleviating this tax burden is essential for enhancing the capacity of small business owners to reinvest in their companies and their communities. Current estimates suggest that passing Proposition 9 could result in over $500 million in savings for Texas small businesses annually, potentially giving Texas an edge in competitiveness against neighboring regions.

Among those advocating for the proposition is the National Federation of Independent Business (NFIB), represented by State Director Jeff Burdett, who has taken to programs like ‘This Week in Texas’ to encourage voter support for Proposition 9. Burdett has emphasized that the substantial tax that business owners face is akin to shaking their business upside down and taxing everything that falls out, rendering their financial standing precarious.

The financial effects of the inventory tax can be stark. For instance, some small business owners have reported paying at least $40,000 annually in inventory taxes, funds that could otherwise be reinvested to foster growth and improve operations within their enterprises. Supporting Proposition 9 is thus framed as a step towards enabling critical economic expansion and stability for small businesses throughout the state.

In addition to Proposition 9, voters will also have the chance to consider a total of 17 propositions during the upcoming election. Among these are Propositions aimed at altering property tax regulations, with Proposition 13 proposing to increase the homestead exemption from $100,000 to $140,000. Additionally, Proposition 11 seeks to raise the homestead exemption for seniors and disabled residents to $200,000. There are also provisions on the ballot for property tax reductions aimed at supporting surviving spouses of veterans and those affected by home damage due to catastrophic events, such as fires.

State Senator Paul Bettencourt of Texas has pointed out that these propositions are part of a broader strategy to provide substantial property tax relief to residents of Texas, diversifying the financial safeguards available to local constituents.

For voters seeking information about polling locations and election reminders, the NFIB has launched a dedicated Voting Hub to streamline access to this vital information. The resource is designed to assist individuals in navigating the voting process as they prepare to make informed decisions about propositions that could impact both small businesses and homeowners across Texas.

This early voting period not only allows for participation in the legislative process but also provides an opportunity for constituents to weigh in on issues critical to their financial wellbeing and that of their communities. As the election date approaches, awareness and engagement among voters will be crucial in shaping the future of Texas’ small business landscape.

Deeper Dive: News & Info About This Topic

- NFIB: Vote Yes on Prop 9

- Houston Chronicle: Texas Constitutional Amendments

- Houston Chronicle: November Voter Guide

- Community Impact: Wilco ESD No. 9 Sales Tax Increase

- Encyclopedia Britannica: Property Tax

Author: STAFF HERE GEORGETOWN

The GEORGETOWN STAFF WRITER represents the experienced team at HEREgeorgetown.com, your go-to source for actionable local news and information in Georgetown, Williamson County, and beyond. Specializing in "news you can use," we cover essential topics like product reviews for personal and business needs, local business directories, politics, real estate trends, neighborhood insights, and state news affecting the area—with deep expertise drawn from years of dedicated reporting and strong community input, including local press releases and business updates. We deliver top reporting on high-value events such as the Red Poppy Festival, Georgetown Swirl, and Christmas Stroll. Our coverage extends to key organizations like the Georgetown Chamber of Commerce and the Downtown Georgetown Association, plus leading businesses in manufacturing and tourism that power the local economy such as local wineries and historic downtown shops. As part of the broader HERE network, including HEREaustin.com, HEREcollegestation.com, HEREdallas.com, HEREhouston.com, HEREgeorgetown.com, and HEREsanantonio.com, we provide comprehensive, credible insights into Texas's dynamic landscape.